Foundation issues are serious damages that require immediate attention. If foundation problems are not tended to promptly, your home could experience further damage and your loved ones could be at risk of injury.

If you’re concerned about the financial implications of foundation damage, you may have questions about homeowners insurance and what it will cover. Read on to learn whether homeowners insurance covers foundation repairs.

The Answer Depends on Your Insurance Plan

Not all insurance plans are created equal. Standard policies will cover foundation damage if it is caused by perils such as natural disasters, fire, or vandalism. However, problems that arise due to neglected routine maintenance are generally not included. For example, if your foundation cracks because of poor drainage or old age, your insurance may not cover the issue. Insurance companies expect homeowners to maintain their properties, which means you must conduct regular inspections and timely repairs. Failing to do so might result in denied claims.

Accidents Commonly Covered by Homeowners Insurance

Insurance companies focus on covering accidents and unforeseen events because they are harder for homeowners to prevent. The policies are designed to protect owners from financial loss due to these unexpected events, ensuring that funds are available when homeowners need them most.

Natural Disasters

Natural disasters can wreak havoc on your home, including the foundation. Events like tornadoes, windstorms, and hail damage count as covered perils in most homeowners insurance policies. These policies typically pay for repairs if the foundation is affected by one of these events.

Erosion

Erosion is another peril your plan might cover. Over time, water runoff can erode the soil supporting your home’s foundation. If erosion occurs due to a sudden and accidental event, you might be in luck with your insurance coverage.

Fallen Objects

During severe storms, there is potential for trees or other objects to fall onto your house. In these scenarios, your insurance policy is likely to cover the repairs.

Vandalism

Vandalism is another situation where your insurance company might step in. If someone deliberately damages your home’s foundation, your policy could cover the repair costs. Vandalism includes any deliberate act that results in property damage, so make sure you document everything thoroughly when filing a claim.

Foundation Issues Insurance Will Not Cover

When foundation damage arises due to predictable scenarios, insurance policies are unlikely to cover the repair costs.

Natural Settling

Natural settling is one of the most common foundation issues, as the process causes minor cracks to form in the foundation. Insurance companies view this as natural wear and tear that doesn’t demand financial assistance.

Tree Root Damage

Tree root damage is another exclusion. Trees growing too close to your home can extend their roots into the foundation, lift the concrete, and cause extensive issues. Insurance companies view this as a maintenance concern that the homeowner should manage through landscaping resources.

Poor Drainage

Poor drainage can lead to foundation problems, but you shouldn’t expect your insurance to cover it. Water pooling around a home due to poor drainage can erode the foundation, and it’s the homeowner’s job to hire a contractor to establish thorough drainage systems.

Improper Construction

Improper construction is also not protected under homeowners insurance. If your home’s foundation problems stem from flawed construction methods or materials, your insurance policy will not accept the claim.

Floods or Earthquakes

In many cases, earthquakes and floods aren’t included in general homeowners insurance policies. These events require additional coverage that you can purchase separately to protect your home.

Homeowners Insurance Add-Ons for Comprehensive Protection

As mentioned, two of the most dangerous natural disasters that aren’t covered by homeowners insurance are earthquakes and floods. Foundation disturbances and other issues that arise due to these events require an additional policy to protect your property.

Earthquakes

The Pacific Northwest is at high risk of seismic activity. Therefore, it’s wise for residents of this region to invest in earthquake insurance. These policies will cover various aspects of earthquake damage, including foundation, concrete, and structural repairs.

Floods

Flooding is a real concern in the Pacific Northwest due to the region’s heavy rains, which is why flood insurance is an essential add-on for homeowners in flood-prone areas. These policies commonly cover the cost of repairing the foundation as well as provide compensation for other impaired aspects of the house.

Steps To Take in Case of an Emergency

1. Call a Contractor To Assess the Damage

When you notice cracks or shifts in your home’s foundation, call a professional contractor for foundation repair solutions. They will perform a thorough inspection to determine the extent of the damage.

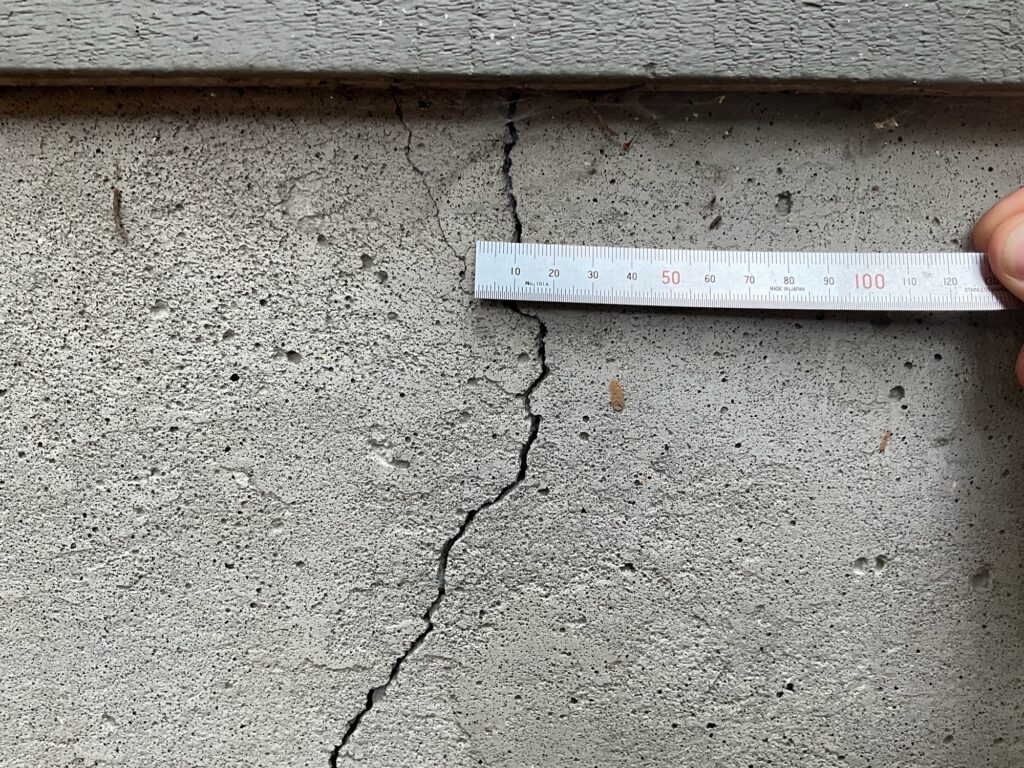

2. Document the Foundation Issues

Documentation becomes your best ally in dealing with foundation issues. Take clear photographs or videos of all visible damage. Make notes about when and why the foundation issues appeared. Detailed record supports your claim and helps your insurance company understand the cause and severity of the situation.

3. File a Homeowners Insurance Claim

Once you have a contractor’s assessment and thorough documentation, contact your insurance provider. Be sure to give them all the details so they can help you determine whether your homeowners insurance will cover foundation repair.

Proactive Home Maintenance

Relying on insurance after damages arise is very helpful; however, nothing beats taking care of your home to minimize the chances of any problems. If you’re concerned with natural disasters impacting your home, consider taking proactive measures to prevent these occurrences.

Earthquake Retrofitting

Earthquake retrofitting involves modifying existing structures to make them more resistant to seismic activity. This process includes reinforcing walls, anchoring the house to its foundation, and bracing water heaters. Retrofitting reduces the risk of severe damage during an earthquake, protecting your home’s integrity and your family’s safety.

Basement Waterproofing

Basement waterproofing entails contractors installing drainage channel systems that guide water away from the foundation. Sump pumps remove excess water, while vapor barriers and dehumidifiers in crawl spaces reduce moisture levels. These measures keep your basement dry and your foundation strong in the event of heavy rains and potential flooding.

Homeowners insurance is essential for safeguarding your property, loved ones, and finances. If you find that your home’s foundation does require repairs, work with our team at TerraFirma Foundation Systems—we’ll help you feel safe in your home.